A strong strategy starts with solid data. At SCORR, our market intelligence team performs surveys regularly for clients and partners to help them update their strategy. However, surveys can be tricky. Identifying the right population to survey, using the right survey instrument, asking the right questions, and analyzing the results are essential in enabling organizations to make educated, data-driven decisions.

One of our recent surveys was a collaboration with Antidote Technologies that resulted in an eye-opening research report: The Patient Perspective on Clinical Trials. Using our work on this survey as an example, we’ll walk you through the steps we took to uncover data about the patient perceptions of clinical trials and their motivations for participation.

Choose the Right Path Forward

Previous research indicated that patients typically participated in clinical research for two reasons: to help others with the same condition and to potentially improve their personal health. However, in order to really understand their unspoken perceptions, needs, and preferences, we wanted to dig deeper. We designed our survey with Antidote and its partners to identify differences related to condition, household income, education, ethnicity, and gender. We also looked at differences between those who had already participated in clinical research and those who had not.

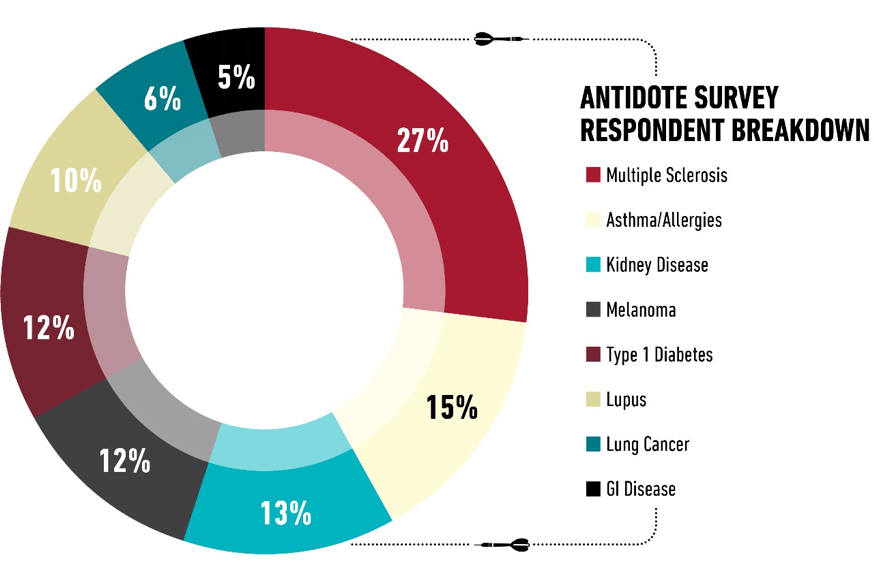

To gather our data, we surveyed nearly 4,000 people, and the majority (89 percent) identified themselves as patients. These included patients with diabetes, kidney disease, lung cancer, multiple sclerosis, lupus, gastrointestinal disease, and asthma and allergies. At the time of data collection, 26 percent of the respondents had participated in a clinical trial.

Analyze the Data

Our team mined the data and what we found was revealing: Patients’ conditions and demographics strongly influenced their thinking about clinical trials. This data, which we detailed in a full survey report, provides valuable information for researchers who are trying to reach these demographic groups.

We also explored patients’ preferences for learning about clinical trials. The results indicate a disparity in how people want to learn and the way they actually learn about clinical trials. Respondents reported that they prefer to receive information about clinical trials from authoritative sources such as medical professionals. In addition, about half of the respondents also wanted to learn more about clinical trials from patients who had previously participated in a study. Respondents were less likely to want information from word of mouth, the drug company itself, or advertisements.

However, when we asked the participants how they had actually learned about clinical trials, more than one-half of all respondents heard about clinical trials through advertisements. Only about one-third heard through their doctor’s office, word of mouth, or an advocacy group.

Furthermore, more than 60 percent reported that they engage with online message boards or in online communities and 88 percent of respondents indicated that information from advocacy groups is helpful or very helpful. All of these findings show that patient communities, advocacy groups, and health and wellness websites play an important role in patient education and outreach.

Apply the Insights

Research is only valuable when it is applied to help organizations support or redirect their strategies. In the case of our survey, the information can be used to engage patients in a way that is more likely to speak to them.

We uncovered differences in patient preferences that can influence patient education and outreach by advocacy groups and companies that conduct clinical research. By applying the survey insights, these organizations can customize engagement strategies to treat patients more like partners in clinical research and help them to feel empowered to make personal health decisions, like considering participation in a clinical trial.

Learn more about The Patient Perspective on Clinical Trials. The report is available here:

Partner With Health Science Marketing Experts

In the survey with Antidote, our focus was on patients and clinical trials. However, our team has conducted hundreds of customized health science industry surveys and secondary research projects that have helped organizations identify influential market trends, gain deeper understanding of brand awareness, perception, and the competitive landscape, and pinpoint stakeholders’ needs and preferences. That information has been used to develop marketing strategies, tactical plans and continuous improvement initiatives, and to benchmark performance.

Finding solid data to support your strategy can be challenging but having a team of experts can help give you the information you need to plan effectively and chart a pathway to success. Find more insights here.